2024 Oil & Gas Emissions Cap POLICY TOOLKIT – 6a. Emissions Trading

Oil & Gas Cap Policy Toolkit

6. Compliance Flexibilities

Toolkit Contents

- EXECUTIVE SUMMARY

- BACKGROUND – THE OIL & GAS SECTOR GHG EMISSIONS PROBLEM

- BACKGROUND – A TRICKY JURISDICTIONAL BALANCE

- HOW THE O&G EMISSIONS CAP WORKS

- THE PROBLEMS WITH THE FRAMEWORK

- The 2030 Cap Level Is Not Ambitious Enough – The Numbers

- The Cap Proposed by the Framework Will Make It Almost Impossible to Meet Our Canada-Wide 2030 Target

- The Framework’s O&G Emissions Cap Will Do Less Work Than It Appears

- The O&G Emissions Cap Has Effectively Been Dictated by the Oil and Gas Producers

- The Oil and Gas Industry’s Re-investments to Reduce Emissions Has Been Contemptible

- The O&G Emissions Cap is based on O&G Production Increasing by 2030

- The “Other Compliance Units” Are Mostly a Very Bad Idea

- COMPLIANCE FLEXIBILITIES

- SUGGESTED RESPONSES TO THE FRAMEWORK’S DISCUSSION QUESTIONS

- I DON’T HAVE TIME TO READ THIS LONG DOCUMENT. WHAT SUBMISSIONS SHOULD I CONSIDER MAKING?

- ACRONYMS & GLOSSARY

The Framework envisions providing the O&G industry with several “compliance flexibilities”, some of which have been briefly mentioned above. This section examines each of the six compliance flexibilities identified in the Framework, as well as a seventh that is not called a compliance flexibility but effectively functions as one.

[1] emissions trading;

[2] multi-year compliance periods;

[3] credit banking, i.e., banking of emission allowances;

[4] contributions to a decarbonization fund;

[5] domestic offset credits;

[6] Internationally Transferred Mitigation Outcomes (ITMOs);

[7] delayed reporting and verification.

a. Emissions Trading

The Framework states:

Emission allowances would be tradeable among covered facilities but would be unique to the oil and gas emissions cap-and-trade system. Likewise, surplus credits, performance credits or other permits or allowances from other regulations or carbon pricing systems, including federal and provincial output-based pricing systems or cap-and-trade systems, would not be eligible for use within the oil and gas emissions cap-and-trade system. [73]

This is the unobjectionable and wholly legitimate “other half” of a cap-and-trade system: Once the government fixes the cap and distributes (in whatever manner is chosen) the permits to emit GHGs up to that cap, individual firms within the industry are free to use the permits to emit GHGs themselves or to sell those permits to other firms within the industry.

If one firm better employs technology, such as Carbon Capture and Storage (“CCS”) than another firm, they may elect to use their permits to produce more oil and gas. If for some other reason they are limited in how much they can produce, they can still profit from their cleaner production by selling their surplus credits to a firm that has had more difficulty with its CCS technology. Doing so might, in turn, help to keep the second firm viable while it improves its CCS technology. This helps to achieve the most economically rational system possible under a cap-and-trade system.

Society does not care which firms emit the GHGs, only that no more GHGs are emitted in total than is permitted by the cap.

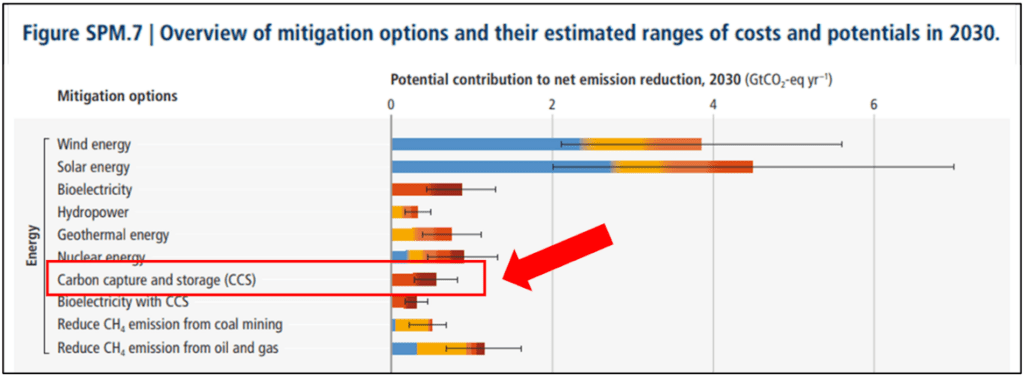

(This assumes that CCS will actually work in an economically viable manner in practice. CCS is one of the most expensive and least effective options to mitigate GHG emissions from the energy sector, [74] but that should be considered as a separate issue.)

Figure 4: Comparison of Energy Sector Mitigation Options and Their Costs [75]

Legend for Figure 4 [76]

The trading of emissions allowances and credits is obviously a key part of the proposed Framework, and it will be crucial to ensure the integrity of the trading system. Without reliable documentation and verification, allowances and credits could purposely or inadvertently be used twice, resulting in twice as many GHG emissions as there should have been. This could jeopardize Canada’s ability to meet our GHG reduction targets.

Before a company can sell allowances or credits, the government or a third party should verify that the reported emissions reductions have actually taken place. In the case of a company selling unused allowances, an auditor should verify that the facility has not in fact emitted those allowances either intentionally or through leakage. Similarly, an auditor should verify that any reported carbon sequestration (i.e., CCS) or purchase of carbon offsets has actually resulted in the permanent removal of GHGs before a company can sell those credits. The trading or selling of credits where GHG removal is not guaranteed to be permanent (e.g., a reforestation project that might later be burned in a wildfire) should not be permitted, as the planet can’t afford these extra GHGs.

Due to the central importance of the integrity of the trading system in delivering the promised GHG reductions, it should be regulated by the federal government rather than audited or managed by a third party. This will help create a trusted market for emissions trading that Canadians can count on.

Recommendations:

Tell the federal government (using references to the papers we cite here, as you may wish):

• Allowing companies to trade emissions allowances (the “trade” part of “cap-and-trade”) is unobjectionable.

• To ensure emissions reduction targets are met, the government must regulate and closely monitor the trading of allowances and emissions credits. Particularly when companies are relying on new technologies such as carbon capture and storage (CCS), it will be important to verify that the reported emissions reductions have actually taken place and result in the permanent removal of GHGs.

Citations

- Framework, p. 7.

- United Nations Intergovernmental Panel on Climate Change, Working Group III contribution to the Sixth Assessment Report, Summary for Policy Makers, 2022, p 38.

- United Nations Intergovernmental Panel on Climate Change, Working Group III contribution to the Sixth Assessment Report, Summary for Policy Makers, 2022, p 38.

- United Nations Intergovernmental Panel on Climate Change, Working Group III contribution to the Sixth Assessment Report, Summary for Policy Makers, 2022, p 38.